Guest Post by Brian C. Albrecht from the American Institute for Economic Research:

An earlier version of this article appeared at Economic Forces.

The dumbest economics discussion over the past few years — and that’s a high bar — has to go to “greedflation.” The White House tried to blame the greed of meat packers and gas companies for rising prices. I would have blamed the Fed for inflation, but I’m no political strategist. According to this theory, inflation rose in the first half of 2022 because, all of a sudden, people became greedy. I guess. They must have become less greedy when inflation fell in the second half of 2022. I don’t know how this theory is supposed to work. Someone write down a model!

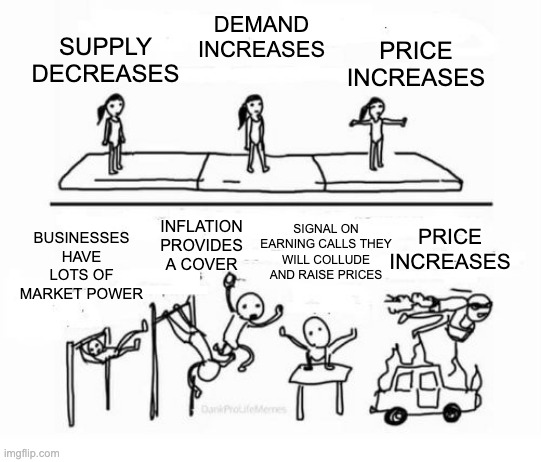

A more economically educated take replaced greed with “market power.” Inflation was high because of high levels of market power in the US economy. Let’s assume such market power exists. Often, people would claim that inflation “gives cover” to firms with lots of pricing power to raise prices. As usual, we can expect to hear the scapegoating from politicians; Rep. Raja Krishnamoorthi claimed, “certain companies and industries are engaged in extreme price hikes under the cover of inflation.” Not to be outdone by the politicians, Federal Trade Commission Chair Lina Khan has expressed this same point on multiple occasions: “an inflationary environment can give cover to companies with market power or monopoly power to exploit that power.”

There are much more articulate versions of similar theories. Isabella Weber on Odd Lots told the story in terms of quantities (and supply bottlenecks) instead of prices, but it’s the same story. She uses the example of Honda and Toyota. Her basic claim is that when Honda experiences a bottleneck and can’t purchase computer chips, they also know that Toyota can’t purchase its computer chips. In response, they both raise prices, knowing the other firm can’t increase output in response.

Translating Prof. Weber’s story into the language of prices: Honda and Toyota both know that computer chips are extremely expensive. However, neither firm will expand production because it is not profitable when computer chips are so costly. Prof. Weber concludes:

So in that kind of situation then both companies that are direct competitors can increase prices in ways that would be very harmful to their position in the market in normal times. So this means that prices suddenly can be hiked in ways where they are no longer controlled by competition in the ways in which we would expect them to be. (emphasis added)

Below, I will explain why this last sentence and Lina Khan’s statement are backwards.

If market power were a big deal, companies wouldn’t need the cover of inflation to raise prices. Monopolies can pass on their cost increases and customers can’t flee to other sellers. Under competition — under supply and demand — firms can only raise prices when other firms’ costs rise. With competition, firms will raise prices together, seemingly “under the cover of inflation.” Instead of being evidence that markets are “no longer controlled by competition,” firms raising prices together is evidence of supply and demand at work.

Your Costs, My Costs, and Our Costs

Recall that when markets are perfectly competitive, each seller does not believe it can change the prices in either the input or output market. Let’s focus on the output market. Honda knows that the going rate for a sedan is $25,000. It faces a perfectly flat demand curve. Suppose its supplier of computer chips raises prices only on Honda because of a shortage. That increases Honda’s marginal costs. However, Honda cannot start selling sedans for $30,000. No one will buy a Honda when the market price for sedans is still at $25,000. Honda needs to absorb that loss. In the long run, it may go out of business if it can’t find an alternative supplier.

Under perfect competition, a firm cannot pass through its cost increases to consumers.

Now consider the other extreme: every car manufacturer sees its computer chip price rise together. In that case, the price of cars will go up. An increase in marginal costs is drawn as a shift left of the supply curve. A general increase in the cost of inputs that affects all car manufacturers (let’s call it “cost inflation”) will generate an increase in the price of cars. This is just supply and demand. Competition generates this price rise.

Now consider a monopoly seller, but let’s go back to the situation where only Honda’s costs rise. If Honda has market power and its costs rise, it will be able to raise the price of a Honda to $30,000. That is what I mean when I say the Lina Khans of the world have it backwards. Firms with market power don’t need the cover of inflation to raise prices! They just pass through their own cost increases.

Market Power as a Free Parameter

I’m being a little harsh. Khan’s statement could be true; inflation could be tied to market power. The problem is that anything that we can explain with supply and demand, we can also explain with a model of market power, like the standard monopoly model. That model has all the features of supply and demand, plus one extra, free parameter: the markup of price over marginal cost. I called it a residual here.

We can always replicate the competitive result in a model with market power. In the case of computer chips, that is a cost increase that hurts Honda and Toyota, who now both have market power. Then both companies will increase their prices, and so all prices rise, just like in the competitive case. In this duopoly case, the cost shock could generate a bigger increase in prices, so there is a partial equilibrium story where market power can exacerbate inflation. Maybe that is what people mean, and the “cover” language means something else.

However, as Robert Lucas taught us, beware of theorists bearing free parameters. In meme form:

I stick with supply and demand whenever possible. Occam’s Razor and all of that. Supply and demand is a perfectly good model to explain inflation, as we’ve stressed before.

Waffle House and the Cost of Eggs

But Brian, why are you talking about inflation? That story is so 2022!

The important point is not just about inflation. Again, for the people in the back:

Under perfect competition, a firm cannot pass through its cost increases to consumers.

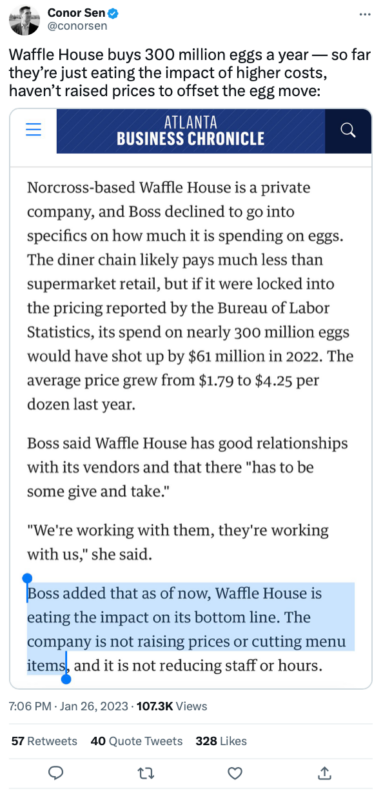

I was reminded of this discussion after a tweet from Conor Sen about Waffle House not raising prices, despite egg costs rising so much in the past few months.

Now we have the tools to analyze this market. If Waffle House is the only restaurant to use eggs, which is the analog of only Honda’s computer chips becoming more expensive, then Waffle House will not be able to pass on its cost rise in the form of the higher price of meals. If all firms use the same ingredients, the higher egg price will drive up the price of meals. Both cases are covered.

But we can also think about the intermediate cases between “only Waffle House uses eggs” and “all restaurants are replicas of Waffle House.” In general, we need to know what happens to the costs of the marginal firm or the marginal meal.

Who are Waffle House’s competitors? If its competitors are trashy breakfast joints, then we can expect all the breakfast spots to use about the same number of eggs. However, if the market is more like “meals out of the house” and people will substitute from breakfast joints to lunch spots, the marginal restaurant may not use many eggs. Still, if all firms use at least some eggs, which means that the marginal firm uses eggs, we should see prices rise to reflect the higher marginal costs.

Either way, Waffle House likely uses more eggs than its competitors. That means marginal costs in the market rise less than Waffle House’s costs; prices will never rise as much as we would think simply by looking at Waffle House’s costs. Remember one of our core insights from price theory: market equilibrium. Waffle House is not in a vacuum, but has to operate in a market.

Then we can go a step further than Econ 101 supply and demand. Waffle House isn’t maximizing today’s profits but the present value of all future profits. If people like predictable prices, sometimes mistakenly thought of as just “sticky prices,” then Waffle House won’t adjust prices instantaneously to the changing costs of the marginal firm. Most restaurants don’t use complex dynamic pricing like Uber to set their prices based on changes in demand. Josh Hendrickson uses the example of game day in a college town.

If the marginal firm’s prices increased because its costs increased, people would want to go to Waffle House more than before. This is a shift out of Waffle House’s demand curve. Just like the game day example, with the simplest version of supply and demand, we would expect these temporary demand increases to translate into immediate price increases, but now we know one reason why prices don’t rise so fast.

As always, we must be careful about rationalizing price movements after the fact. That’s always a concern, and halfway-clever economists can think about supply and demand explanations for basically everything. I can, and I’m not very smart.

But the question is always, compared to what? It’s even easier to rationalize stuff when you also have the free parameter of market power! Or worse, if you allow greed to be an explanation. One of the benefits of price theory is that by sticking to a few simple models, it places a constraint on the theorist. That is valuable.

Guest Post by Brian C. Albrecht from the American Institute for Economic Research.

Former CIA Officer Reveals Covert Tactics To Avoid Financial Ruin

Not Only Are We Facing Surging Inflation and a Crashing Market…

You ALSO Have to Watch Out for Thieves, Predatory Lawyers, and Government Money-Grabbers…

Get flush with cash, protect your 401k, retirement funds & investments.