The past decade’s historically low interest rates convinced millions of Americans to buy cars they could only afford with hyper-cheap credit. This made auto sales one of the drivers of the recovery, but it also left far too many people with underwater “car mortgages” that will limit their spending on other things and prevent them from buying their next car until sometime in the 2020s.

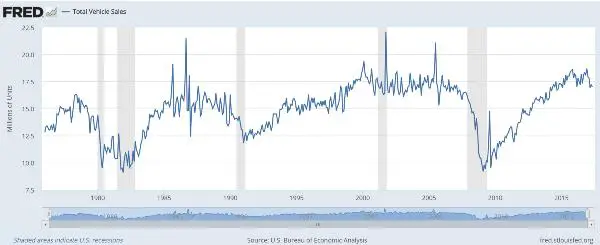

Like all artificial (that is, credit-driven) booms, this had to end eventually, and it’s looking like now is the time:

U.S. Auto Makers Post Sharp Sales Decline in June

(Wall Street Journal) – Detroit’s car companies reported steep sales declines in June, capping a bumpy first half of the year for the U.S. auto industry and setting a bleak tone for the summer selling season.The reports, released Monday, come as analysts expect overall auto sales to have fallen more than 2% in June compared with the prior year, according to JD Power. The firm said the industry’s selling pace hit its lowest point since 2014 over the first six months of 2017, and traffic at dealerships—measured by retail sales—fell to a five-year nadir in June.

Edmunds.com, a consumer-research company, said buyers are stretching more than ever to afford cars and trucks that are growing increasingly more expensive due to a barrage of safety gear and connectivity options. The firm estimates the average auto-loan length reached a high of 69.3 months in June, with the average amount of financing reaching $30,945, up $631 from May.

General Motors Co. GM +2.91% said U.S. sales fell 5% to 243,155 vehicles, while Ford Motor Co. F +4.07% said sales totaled 227,979 vehicles, down 5.1% from a year earlier, and Fiat Chrysler Automobiles N.V. posted a 7% decline to 187,348 vehicles.

The following charts show a steady rise in car sales and inventories from their 2009 low to a 2015-2016 peak. If they’ve shifted into a cyclical decline the bottom, based on history, is a long way down.

Meanwhile, the cheap lease deals of the past few years are starting to run off, producing a tidal wave of nearly-new used cars to compete with much more expensive new ones. The result: falling used car prices that will, over time, cut demand for new cars even further.

Used cars are getting cheaper: CarMax

(Fox News) – CarMax (KMX), the nation’s largest used-car retailer, reported a decline in selling prices during its fiscal first quarter.Used-car prices are expected to decline this year, as vehicles leased during the U.S. auto sales boom in recent years begin to hit the market. Manufacturers and dealers are closely watching price trends because cheaper used cars could soften demand for new vehicles .

CarMax CEO Bill Nash said Wednesday the Richmond, Virginia-based dealership chain has already seen an influx of off-lease vehicles, which is driving prices lower.

“As more of them come in, prices will continue to drop,” Nash told analysts during a conference call.

The trend put downward pressure on CarMax’s average selling prices for the first quarter, offsetting a high mix of more expensive pickup trucks and SUVs. CarMax sold used vehicles for $19,478 on average, a 1.9% drop from the year-ago quarter’s average selling price of $19,858. Prices for wholesale vehicles also fell 2.9% to $5,113.

This is obviously bad news for an economy dependent on people buying stuff they don’t need with money they don’t have. So other things being equal, expect disappointing numbers for GDP, inflation, wages, etc., going forward as this major industry morphs from tailwind to headwind.

And expect the process of interest rate normalization to become an even harder sell for the Fed, which needs a boom to justify making loans more expensive for tomorrow’s car and house buyers. As the saying goes, it’s inflate or die.

21 thoughts on "Car Sales Have A Long Way To Fall"

“inflate or die.”

Actually, its inflate now and die later.

Car sales I think that this year will go up. Luxury cars have a great future and will never stop to make good sales. It is not enough to make limit up the shop of cars only from luxury cars but I think that there will not be problem. dodland.com supports dollarcollapse about the great economy articles.

LOL, no, car sales won’t go up this year.

Here, read this:

http://money.cnn.com/2017/07/03/news/companies/june-car-sales/index.html

It’s great for a car owner to see this.

Cars and trucks that are growing increasingly more expensive due to a barrage of safety gear and connectivity options.

That isn’t a joke at all….try finding a new “work” truck. Now a days they come with 3 bedrooms, 2 baths and a finished basement. Or at least that is what I assume by the prices I see…….BTW, real trucks don’t have 4 doors.

or 4 plug-ins for your music.