Friday was one of those days when so many markets move so dramatically that it’s hard to know what to focus on. But in this case the headline numbers – US stocks way up, gold way down, foreign markets all over the place — matter less than the interest rate on 10-year Treasuries, which spiked:

The reason this number matters is that a return to “normal” times of high employment and fast growth also means a return to normal interest rates, which would be about twice current levels. This creates one or two little problems for a society with trillions of dollars of debt to roll over each year. Already, with the 10-year moving just from 1.7% to 2.2%, the junk bond market is suffering:

The Day The Big Fat Junk-Bond Bubble Blew Up

My friends in the corporate restructuring industry aren’t breaking out the bubbly just yet. But with one eye, they’re gazing wistfully into the distant horizon where they’re seeing the first signs of a glimmer of hope. And with the other eye, they’re gazing at the screens of their smartphones and computers where they’re seeing brutal junk bond rout.

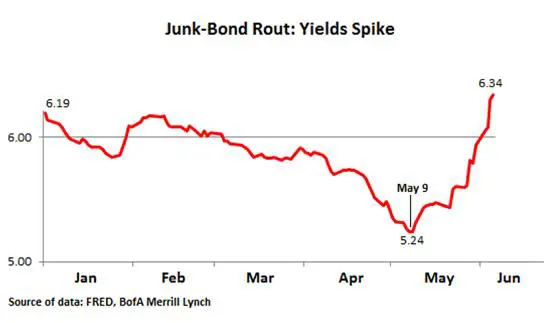

Junk bonds had a phenomenal run. With each truckload of free money that the Fed and other central banks delivered to the markets, junk-bond valuations soared and yields plunged. The St. Louis Fed’s BofA Merrill Lynch junk-bond yield index, which was deep into the double digits during the financial crisis, hit a low on May 9 of 5.24%, down from 6.19% at the start of the year. Yields on some of the least bad junk in the index were well below 5%.

Before these crazy times that the financial crisis brought, you could buy an essentially risk-free 1-year FDIC-insured CD with an interest rate of 5%. But recently, desperate investors, mauled by the Fed’s zero-interest-rate policy and losing ground to inflation, were furiously grabbing yield wherever they could, taking on risks no questions asked, any risks no matter how large, to get to that 5% yield. A feeding frenzy for junk. Companies took advantage of this Fed-induced desperation and bamboozled investors into gobbling up $187 billion in junk bonds so far in 2013, a record!

One of the losers of the Fed’s policies was the corporate restructuring industry. With endless amounts of nearly free money available, even teetering companies with too much debt and money-losing operations could borrow more to cover up any holes. So my friends and their restructuring outfits branched out into performance-improvement consulting and financial advisory, and some have left the business altogether.

Bubbles balloon to an absurd magnitude. But one day the feeding frenzy dies down, and gradually, or sometimes suddenly, the risks, the silliness, the illogic, the whole nonsensical nature of the bubble move into the foreground for all to see, and more and more people open their eyes and see it. Some of them will try to get out somehow, quietly at first, by looking for the greater fool. And there are plenty of them, for a while. But new investors want to be compensated for the risks they’re now seeing, and they’ll demand higher yields in return for taking on those risks. That day might have been May 9 – when the air started hissing out of the junk bond bubble. What came afterward was a rout. And a spike in yields:

And mortgage refinancing is drying up:

Refinancing Activity Continues to Shrink as Rates Jump to Recent Highs

There was another substantial drop in mortgage applications during the week ended May 31 as rates increased, in some cases to 13 month highs. The Mortgage Bankers Association (MBA) said results of its Weekly Mortgage Applications Survey showed an 11.5 percent decrease in its Market Composite Index, a measure of mortgage volume, on a seasonally adjusted basis from the week ended May 24. The Composite was down 20 percent on a non seasonally adjusted basis.

Rates for the conforming 30-year fixed-rate mortgage (FRM) had the biggest single-week increase since July 2011, jumping from 3.90 percent to 4.07 percent, the highest rate since April 2012. Points decreased to 0.35 from 0.39.

The average rate for 30-year jumbo FRMs (loan balances greater than $417,500) increased by 13 basis points to 4.20 percent, the highest rate since May 2012. Points increased to 0.28 from 0.27.

FHA-backed 30-year FRMs also increased to the highest level since May 2012, 3.76 percent, from 3.62 percent the previous week. Points increased to 0.32 from 0.27. The rate for 15-year FRMs reached the highest level since June 2012, increasing to 3.23 percent with 0.38 point from 3.10 percent with 0.30 point.

The Bottom line: Even a small rise in long-term interest rates translates into a lot less credit available for marginal borrowers. Homeowners trying to get a lower rate on their mortgage to free up cash for college loans or to put gas in the car will see that window close. Weak, highly-leveraged companies will have to get by with internally-generated cash – which many of them don’t have.

The government, meanwhile, will have to roll over its debt at ever-higher rates or ever-shorter duration, leading to a rising deficit in the first case and increased exposure to future interest rate changes in the second. Either way, the system gets more instead of less fragile.

The fact that a highly-leveraged economy can’t cope with rising rates is the modern world’s Catch-22: Rates have to rise if the economy keeps growing, but the economy can’t grow if rates rise.

3 thoughts on "The Number That Matters"

I think investors are on the cusp of realizing how precarious things are. They may be fretting about the Fed “tapering” it’s debt monetizations soon but they’re going to shit when they realize that the Fed won’t ever be able to stop and that the Fed’s interventions are literally prohibiting economic growth.

Yes, the only number that matters is the Interest Rate on the US Government Note, ^TNX. its jump higher constituted a hard frost, that is a quick freezing to death of fiat money.

Fiat money died on May 24, 2013 with the failure of currency carry-trade

investing, ICI, and disinvestment out of Junk bonds, JNK, on the

failure of the world central banks’ monetary authority, and especially

the Bank of Japan’s Kuroda Abenomics monetary policies.

A hard killing frost came to the credit market, with a parabolic

steepening of the 10 30 US Sovereing Debt Yield Curve, $TNX:$TYX, seen

in the weekly chart of the Steepner ETF, STPP, rising parabolically in value.