Mortgage REITs are companies that borrow money to buy mortgage backed securities (MBS) and earn the spread between their cost of funds and the yield on their MBS. When interest rates are going down and MBS are performing well these guys make fortunes. But when interest rates go up and bond prices fall, their excessive leverage kills them. They were, in fact, among the earliest casualties of the housing bust just a few years ago. Now they and their memory-impaired investors are back in the same mess:

REITs Deepening Bond Losses as Leverage Forces Sales

Annaly Capital Management Inc. (NLY)’s Wellington Denahan, head of the largest mortgage real-estate investment trust, told investors less than three months ago that reports REITs could threaten U.S. financial stability were as misleading as the media frenzy over shark attacks in 2001.Since the May 2 comments, shares of the companies, which use borrowed money to make $400 billion in credit market bets, dropped about 19 percent through yesterday and the value of their assets has plunged after the Federal Reserve triggered a flight from bond funds by signaling plans to slow its debt-buying program.

REITs may have needed to sell about $30 billion of government-backed mortgage securities in just one week last month to maintain the amount of borrowing relative to their net worth, according to JPMorgan Chase & Co. Those types of sales deepened losses in the mortgage-bond market, which had the worst quarter since 1994, accelerated the exit from fixed-income funds and fueled a jump in home-loan rates to a two-year high.

REITs “have been one of, if not the biggest contributors” to the underperformance and volatility in mortgage bonds, said Bryan Whalen, co-head of mortgage bonds at Los Angeles-based TCW Group Inc., which oversees about $131 billion of assets.

Mortgage rates jumped to 4.46 percent at the end of June, up from a near-record low of 3.35 percent in early May, after the central bank indicated it will taper its monthly debt buying, including $40 billion of government-backed housing debt. Investors pulled about $60 billion from U.S. bond funds in June, the biggest monthly redemptions in records going back to 1961, according to estimates from the Investment Company Institute.

Cheap Financing

Firms including Annaly, American Capital Agency Corp. (AGNC), the second biggest of the companies, and Armour Residential REIT Inc. (ARR), sell shares to the public so the capital can’t be redeemed. They also rely on leverage, typically using about six to eight times the amount of borrowed money compared with their capital.That means they benefited from cheap financing as the Fed kept short-term interest rates near zero for more than four years. REITs more than tripled holdings of government-backed home-loan bonds since 2009 and their increased buying power helped push down mortgage rates.

“The industry relies on leverage, and leverage cuts both ways,” said Ken Hackel, the head of securitized product strategy at Stamford, Connecticut-based bond broker CRT Capital Group LLC. “In good times it generates above-market returns. But when times get tougher, it creates challenges tied to the need to unwind it.”

The REITs, which focus on property-linked assets and avoid taxes by paying out 90 percent of their earnings, lured investors with returns of 19 percent last year and dividends in excess of 13 percent, almost twice the average yield on company junk bonds.

Some thoughts

Here’s a general rule of thumb: When long-term bonds are yielding 3% and someone tries to sell you a REIT that yields 13%, they don’t have your welfare in mind. You’re being ripped off and will discover this fact very soon. Consider the resulting losses to be tuition at Experience University.

Our collective memory seems to be getting shorter. It used to take a whole generation for a burst bubble to regain the trust of investors, but lately we’ve compressed the cycle to just half a decade. What’s next, subprime mortgages or dot-coms?

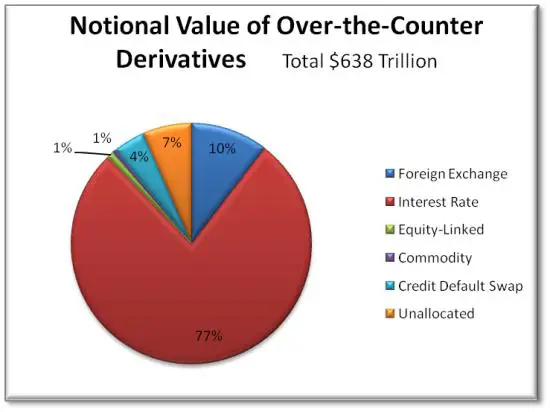

The mortgage REITs are just a small part of the leveraged speculating community, so their implosion, if that’s what is happening, won’t directly affect the rest of us other than through slightly higher mortgage rates. But interest rate swaps are another story altogether; they dominate the derivatives market are even more leveraged than mortgage REITs. After the past month’s rate spike a lot of leveraged players are sitting on some massive losses. Let’s see what happens when they come to light.

8 thoughts on "Variable Rate World, Part 2: Mortgage REITs Get Crushed"

I, for one, would like to see all investments based upon the success of central banking to go bankrupt but I still think it’s too early for that. If interest rates rise too quickly then there could be problems but even that is no guarantee because I think just about anything will be done to circumvent them, including the non-enforcement of derivative contracts.

I was very suspicious when Bernanke mentioned that QE “tapering” may begin later this year if the economy continues to improve. That was so unnecessary. Everyone was already expecting that to occur if and when the unemployment rate dropped to 6.5% or annual inflation exceeded 2.5%. Besides, Bernanke is supposedly very concerned about ending monetary support too early, as he believed that was the main error made by the Fed in the 30’s. Furthermore, attention on the national debt and deficit this Fall would tend to raise interest rates even more, so to begin tapering then made no sense to me.

It’s no surprise that Bernanke confirmed yesterday that QE will continue for the foreseeable future, and the BOE and ECB has announced future interest rate “guidance” so markets don’t “overreact” again. Unfortunately, I think investors will believe them so interest rates may go back down now or just stay at these levels. Too many people are still too confident in the Fed’s/CB’s insights and capabilities.

One of a central banker’s tools is bullshit rhetoric. Bernanke is burning through his credibility by talking out of both sides of his mouth. He wants to keep the bubbles from inflating too far, too fast, and hence the taper talk. At the same time he now realizes, if he didn’t already, that the financial markets are addicted to QE and even the hint of cutting back gives them a heart attack so he could never abandon QE without a severe downturn in the markets and associated demanding by institutions and the public for him to to reinstate it. It’s QE until collapse and a new monetary paradigm. You make good sense in saying that everything will be done to circumvent problems, including not enforcing derivatives. I also think that rates will only go up far despite the fed’s best efforts to keep them low. BTW, I don’t discount the possibility that the 10 year treasury goes to 1% as a last inkling of safe haven status if/when Japan and/or Europe blow up!

So if you have some “speculative” money how can you cash in on this? I am betting Obamacare was pushed back to allow the Fed to tighten so it all does not happen at once. This means the Fed is going to taper starting at the end of the year and continue slowly next year. If this is correct how can you cash in on this? It would seem there are some gigantic speculative opportunities out there.

Also, as a side question, banks are not lending because they borrow short and lend long but the coffers are exploding because of QE. Since interest rates have nowhere to go but up, once they start the banks will start lending again. Could this be the precurser to big inflation?

The little black boxes in banks have turned into $638 trillion black boxes, and will not be paid. What can’t be paid will not be paid as a “debt jubilee” will be in our future.

Thanks for recognizing the interest rate linked derivative position for what it is, a financial time bomb (mainstream biz news is completely missing the issue of course). Failure of counterparties in a systemic event, and rising interest rates are obviously systemic, will shock the many entities who believe they are hedged against rate increases. The inevitable financial bloodbath will be truly epic. Of course the Fed will act to try and paper it all over taking us to the inevitable inflationary calamity. One has to wonder how those in the financial community fail to anticipate such an obvious outcome.

This sounds spot on to me. Counterparty failure could cascade across oceans at the speed of light and lead to bank holidays, while there are 10 electronic dollars to be frozen for every physical dollar out there. As or more importantly, the US and Canada have already, or are in the process of crafting bail-IN language. And FDIC doesn’t have but a small, small fraction of insurable deposits in reserve.